does maryland have a child tax credit

The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. The credit would be available to all children up to age 5 while maintaining.

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

Families could be eligible to.

. 311 West Saratoga Street Baltimore MD 21201. 1-800-332-6347 TTY 1-800-735-2258 2022 Marylandgov. State residents who have filed their 2021 return by June 30 will get a physical check for 750 by Sept.

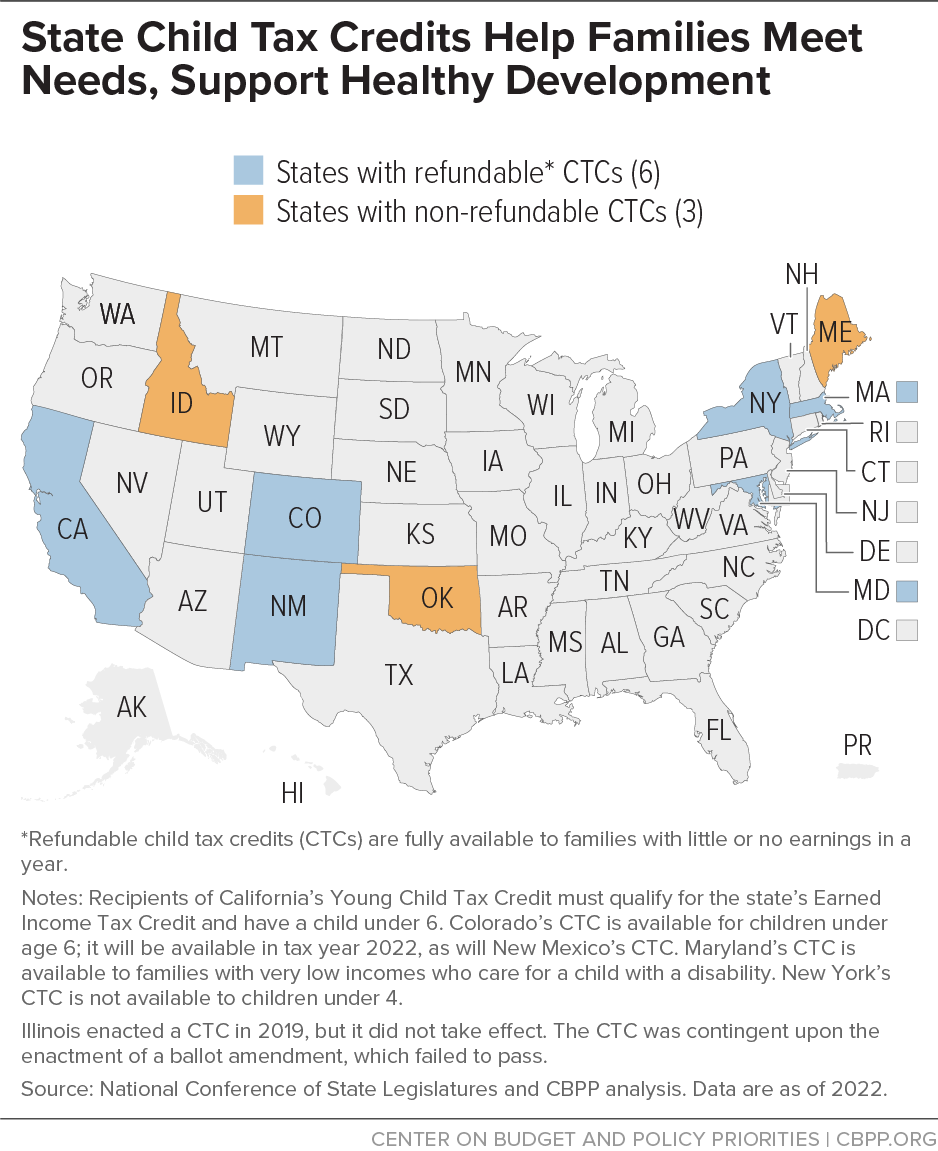

Child Tax Credit for low-income families with children under 6 who have disabilities Some of these programs phase in with income and nearly all phase out with. Every county and municipality in Maryland is required to limit taxable assessment. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or.

Each household could receive. The Child Tax Credit has been expanded to reach additional children in Maryland many of whom are in families that do not realize theyre eligible for these funds. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. 30 thanks to the 1992 Taxpayers Bill of Rights TABOR. Tax Credits and Deductions for Individual Taxpayers.

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767-5915. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the requirements for claiming the Child Tax Credit. The credit would be available for families with income under 15000 up from the current 6000 limit.

Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. CASH Campaign of Maryland 410-234-8008 Baltimore Metro. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year.

Opinion Means Tested Tax Credits Punish The Poor For Working Maryland Makes It Worse Maryland Matters

Maryland Historical Trust Sustainable Community Street View Historical

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit Which States Could Receive Up To 750 Marca

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Tax Credit Available For Families With Children Dhs News

Tax Credit Available For Families With Children Dhs News

Ashcraft Appliances Fireplace Installation Maryland Fireplace Appliances Installation

Eleven States With Their Own Child Tax Credit Programs Can You Get Up To 1 000 Extra Per Child The Us Sun

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet